Build vs. Buy

5 Pitfalls to Building Donate-at-Checkout In-House

If you’re considering implementing a donate-at-checkout solution, you’ve no doubt explored whether building or buying is the right path for your team.

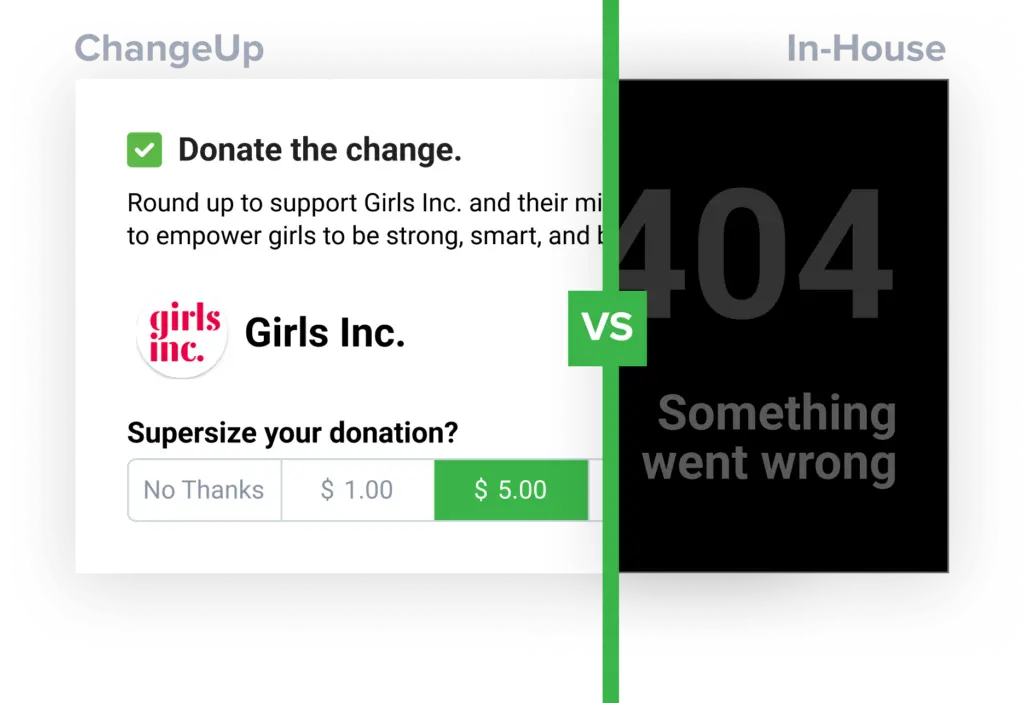

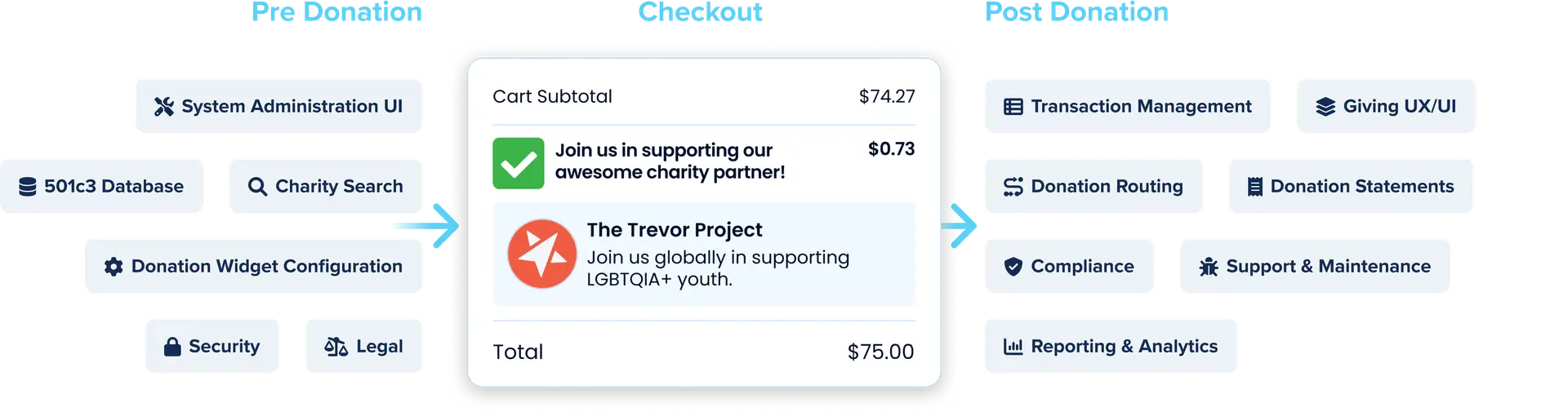

Adding a donation widget to your brand’s online checkout flow might seem like a simple proposition. However, there’s much more going on behind the scenes than you might assume.

Through partnering with some of the world’s largest enterprise e-commerce brands, the ChangeUp team has identified five key pitfalls that teams often confront when attempting to “hack” together a donation solution in-house.

Pitfall #1

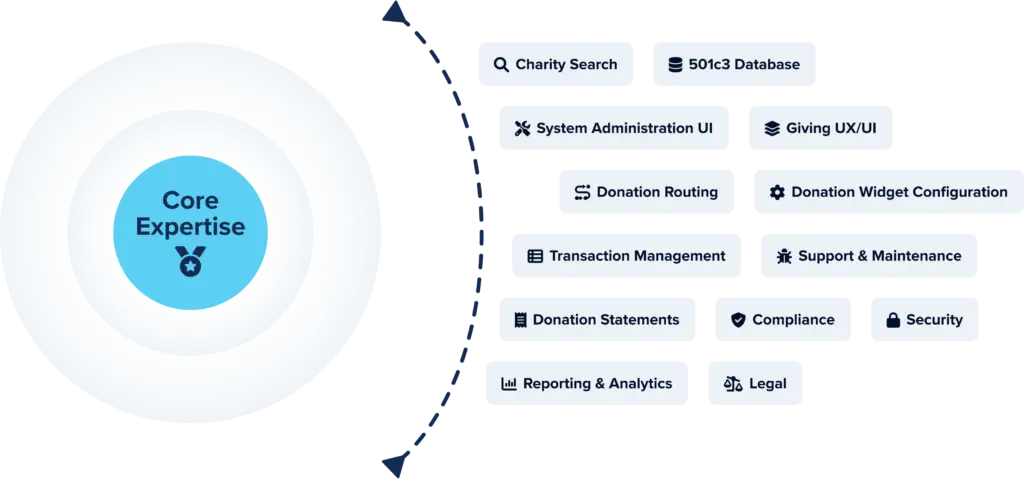

Diverting Internal Teams from Core Expertise

Here are just a few things you’ll need to address:

Pitfall #2

Underestimating Build, Hacked Solutions, No Scalability

We’ve learned over time that the most effective solutions allow for multiple donation types (round-up vs. fixed dollar amount), are flexible in placement and layout, and tie into a deep backend system.

Customer experience is critical. It’s particularly important that the invitation to donate happen at checkout, rather than “orphaned” or buried on a standalone page.

The ChangeUp donate-at-checkout solution is a highly customizable and lightweight widget that can be injected directly into the checkout flow and reads your transactions to easily calculate round-ups and maximize customer participation.

Pitfall #3

Misconceiving Charity Diligence

Did you know there are approximately 1.5 Million 501(c)3s in the United States? Not only that, but the IRS charity database is constantly evolving as new charities are formed and others cease operating.

In addition, at any given time there are approximately 100 charities that have been deemed bad actors by the Southern Poverty Law Center, meaning they’re either operating as hate groups or collecting donations for nefarious purposes.

On-boarding and maintaining charities in-house – especially if your brand intends to support multiple charities at checkout and wants the flexibility to change them frequently – can easily become a full-time job (we’ve seen it happen!).

If you decide to embark on building an internal charity database, you’ll want to ensure that you have processes in place for:

- Vetting charities

- Collecting assets (logo, mission statement, banking info)

- Reporting donations to the IRS

- Distributing donations in a tax-compliant manner

- Updating your database monthly

Pitfall #4

Ongoing Costs of Internal Support

Ensuring that your team plans ahead for ongoing support is non-negotiable.

You’ll want to consider:

Administrative Support

- How easy is it for a non-technical person to maintain the front-end giving campaigns?

- How will accounting get the data they need to reconcile transactions and report donations to the IRS?

Technical Support

- How will the donation infrastructure be maintained?

- Has your team allocated time on its roadmap to address bug fixes, code updates, and compliance/security needs?

- How will you handle reporting and analytics?

Charity Management

- Who will be responsible for maintaining charity relationships over time?

- What will your team do if a charity suddenly stops cashing checks, ceases to operate or becomes non-responsive?

Pitfall #5

Failing to Meet IRS Compliance

The IRS stipulates that every single penny that is donated must be tracked, reported, and receipted. If your brand is using a charity’s name or logo to help promote sales, it must get permission from that charity or risk being in violation of cause marketing regulations.

The ChangeUp team has spent years building a secure system that allows e-commerce brands to publish charities at checkout and move funds using a compliant and reliable process.

Our software is SOC 2, Type 2 and PCI SAQ A compliant. It also allows for in-depth reporting and analysis to ensure that every single penny that’s donated on your site is accounted for.